You Can’t Manage Wealth You Can’t See: Making Crypto Holdings Visible in Wealth Tech

Oct 23, 2025

Breslin, Dominic

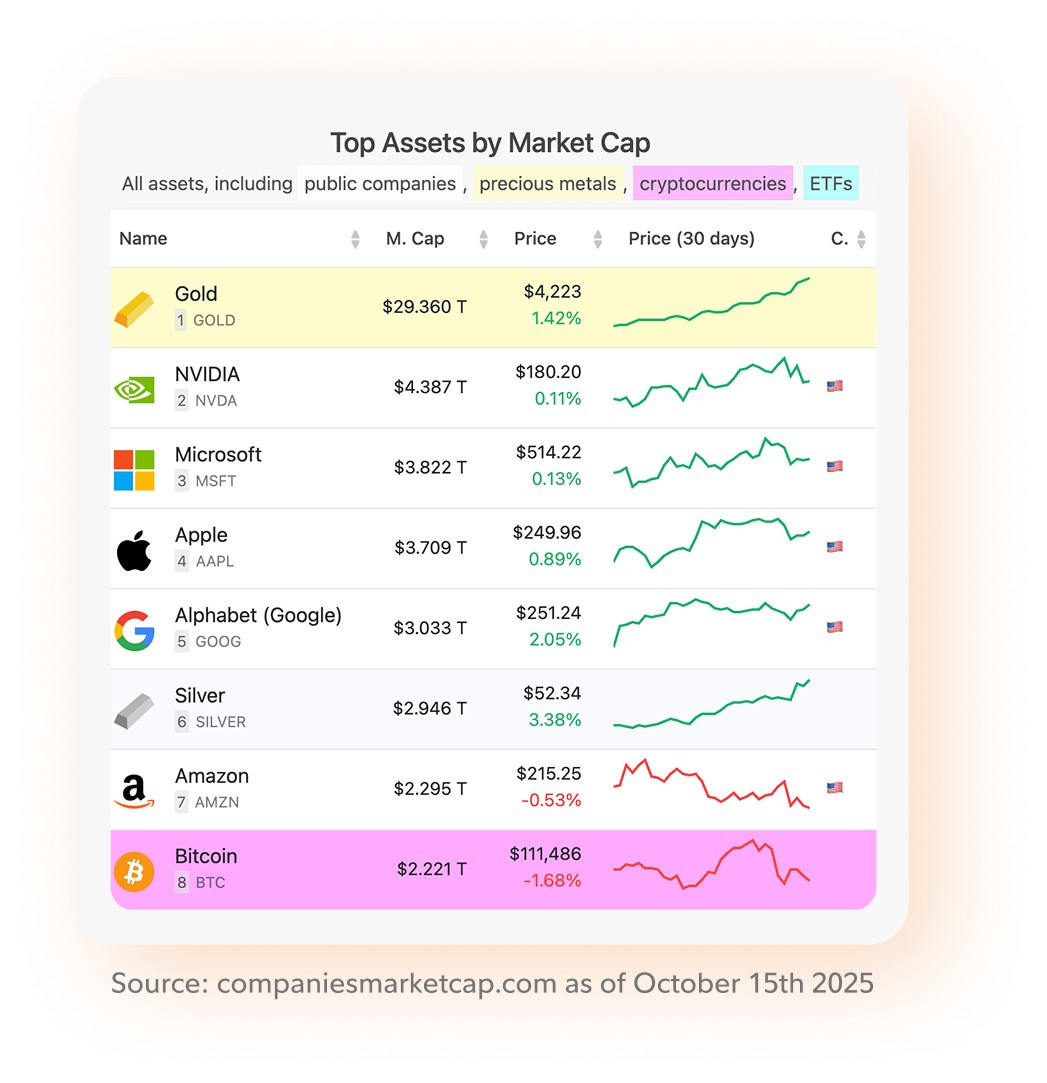

If you're building or modernizing a wealth platform in 2025, it's hard to ignore how client portfolios are evolving. Crypto is no longer contrarian. Bitcoin is a top 10 asset class by Market Cap. It’s part of the financial picture, even if it makes up a small percentage of holdings.

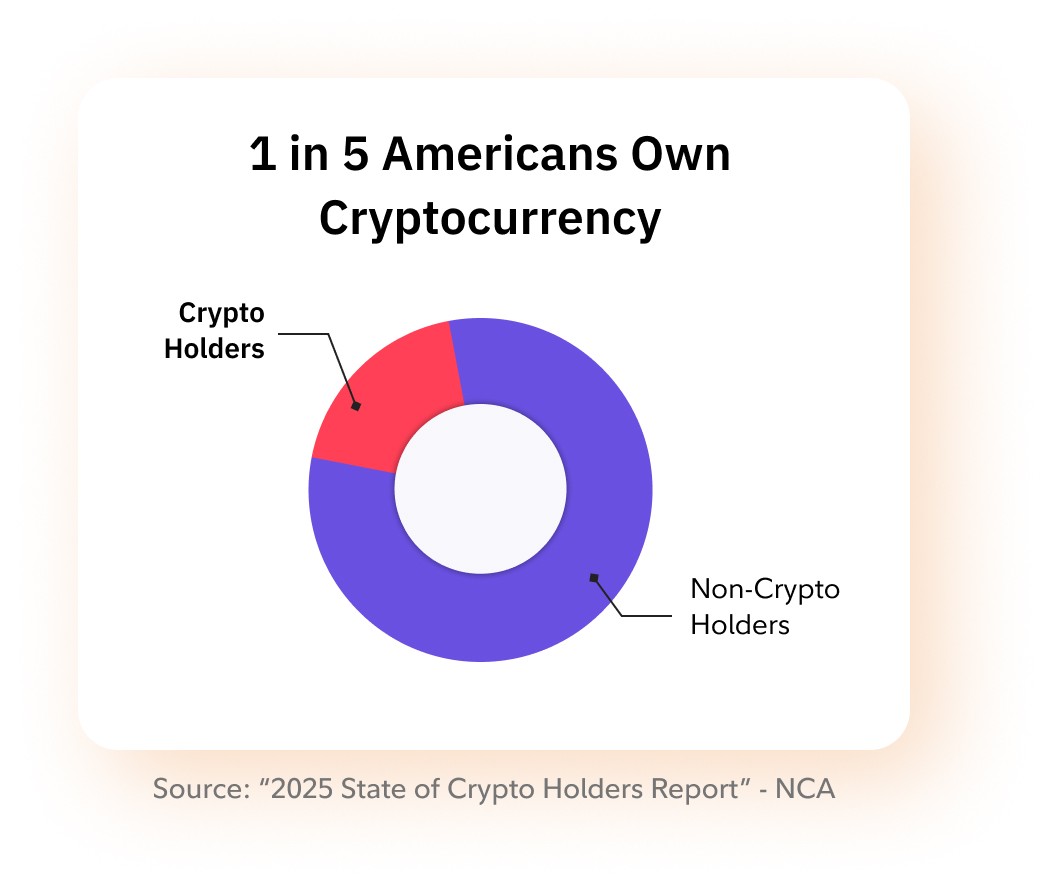

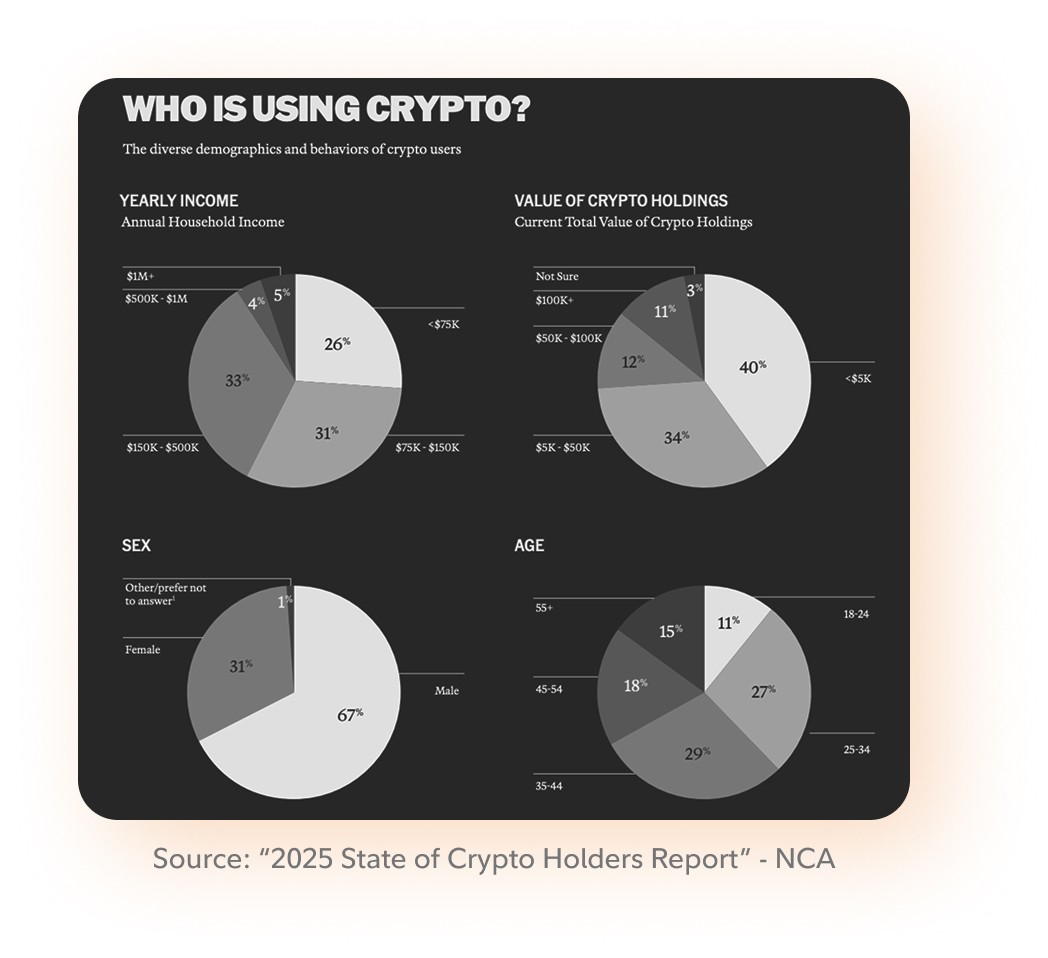

Roughly 1 in 5 US adults hold crypto in some form. Wealth techs that recognize this today, and provide visibility into it, will be the ones positioned to capture value as the market matures and adoption continues to grow.

"History doesn’t repeat but it often rhymes"

Advisors and product teams have been here before. Bank feeds, account aggregation, open banking etc. Every leap in tech doesn’t remove the need to give investors and advisors the full picture, without friction. Crypto is simply the next dataset. But as of now, it’s missing from many advisor workflows.

Advisors are:

Skipping crypto entirely in planning conversations

Managing manual uploads or one-off integrations with limited coverage

Working around data gaps

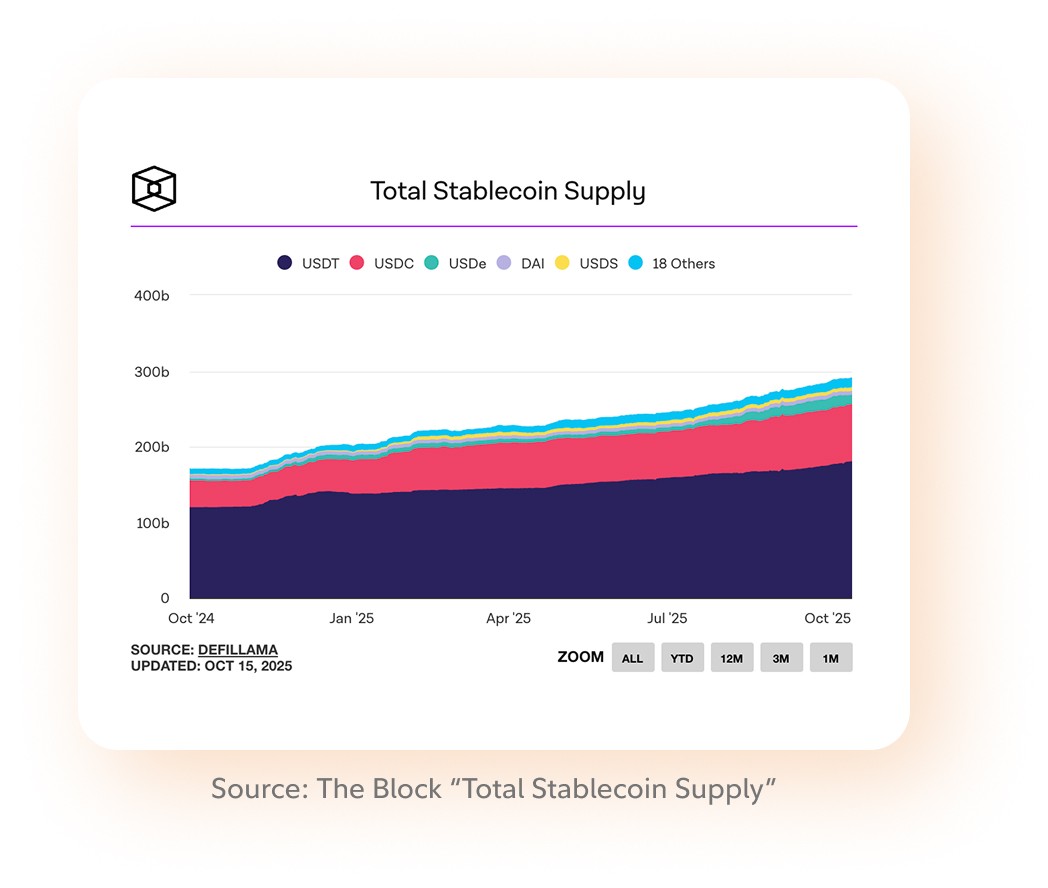

This not only hides potential AUM (assets under management), it can distort the client’s overall risk profile. A user who appears conservative on paper might actually have significant exposure in BTC, ETH, or stablecoins (think of these as digital dollars) held off-platform.

Visibility and clarity is what advisors and investors need

They need reliable, daily performance data that advisors can trust and plug into their existing systems with minimal engineering effort.

That includes:

Balances from major exchanges and wallets

Detailed transactions data

Coverage for DeFi and increasingly popular crypto activity

OAuth-based (easy log in) permissioning wherever possible

Standardised formats that work with their systems

The utility is in the follow-on effects

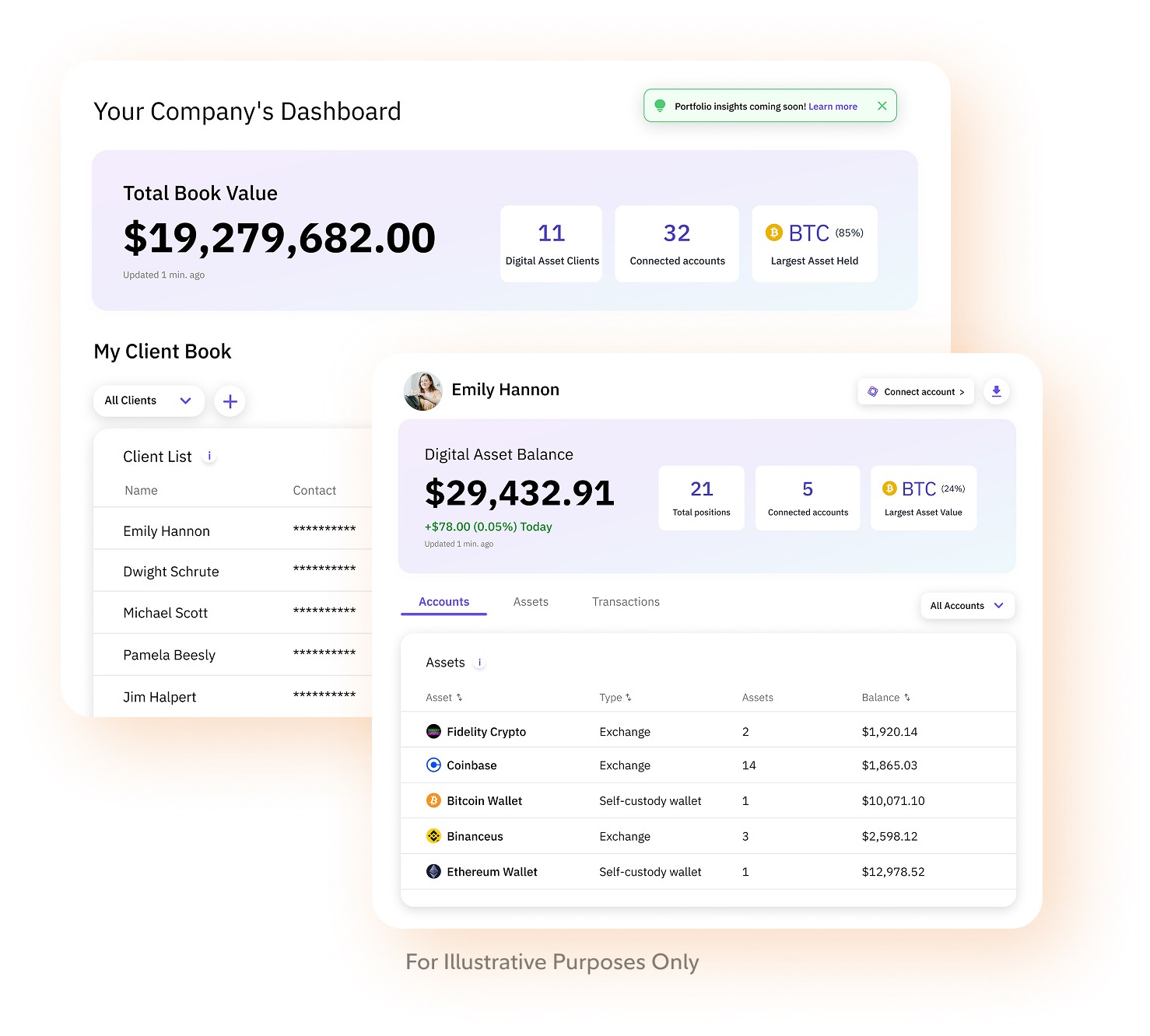

Normalized, permissioned access to crypto data doesn’t just fill a gap. It opens up new features to enable both advisors and investors to make more informed decisions.

Examples:

More complete portfolio breakdowns and reporting

Ability to alert on large inflows or outflows from wallets

Context for advisors dealing with self-custody clients

"Bitcoin is up 15% since your last buy"

Tech teams should be focused on building the features users need, not focusing on understanding the data.

Coverage as a competitive lever

Our coverage spans over 90%+ of the exchange and wallet sources used by US-based crypto holders. Which means wealth platforms can offer large scale visibility with one integration.

What forward-looking wealth platforms already see

This is about supporting growing demand and being prepared.

Crypto isn’t a trend. It’s an asset class held by:

Younger, high-potential clients

Technologically savvy segments

People who started small but now hold meaningful sums

There is a sea change in US regulation towards crypto so product readiness is paramount and can be a competitive differentiator. Offering crypto data signals a platform that understands not only where users increasingly are but where clients are going.

Crypto doesn’t need to be front and center. But it does need to be handled

Investors expect their platforms to keep up, otherwise they move. Advisors need the full picture to give meaningful advice. And product and engineering teams shouldn’t have to become blockchain devs or work with duct-tape solutions to deliver a quality customer experience.

Make crypto data like any other data set, wealth tech has been here before.

————————————————————————————————————————————————————————

The content in any Calico™ branded applications, products, and services (collectively, “Services”) is purely informational and should not be considered legal, compliance, investment, tax, or insurance advice. You should not use the Services to make any financial decisions, including whether to purchase or sell any digital asset. Screenshots and graphics are for illustrative purposes only. Calico cannot and does not guarantee the accuracy, completeness, or timeliness of, and does not endorse, content provided by third parties. Your use of any third-party source in connection with these Services, including your use of any third-party site to which a link is provided, may be subject to separate terms and conditions of such third party. Your use of these Services is subject to the Calico Privacy Policy and Terms of Use. This is for persons in the U.S. only. Calico and the Calico logo are trademarks of entities affiliated with Calico Digital Assets LLC. Third party trademarks appearing herein are the property of their respective owners. © 2025. All rights reserved